UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATIONProxy Statement Pursuant to

Section 14(a) of the Securities Exchange Act of 1934(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) | |||

| ☒ | Definitive Proxy Statement | |||

| ☐ | Definitive Additional Materials | |||

| ☐ | Soliciting Material Pursuant to | |||

Sealed Air Corporation(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Sealed Air Corporation | ||||

| (Name of Registrant as Specified In Its Charter) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

(2) | Aggregate number of securities to which transaction applies: | |||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

(4) | Proposed maximum aggregate value of transaction: | |||

(5) | Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

(2) | Form, Schedule or Registration Statement No.: | |||

(3) | Filing Party: | |||

(4) | Date Filed: | |||

| ||

| Sealed Air Corporation 2415 Cascade Pointe Boulevard Charlotte, |

April 6, 20175, 2018

Dear Fellow Stockholder:

It is my pleasure to invite you to attend the Annual Meeting of Stockholders of Sealed Air Corporation to be held on Thursday, May 18, 2017,17, 2018, at 10:00 a.m., Eastern Time,daylight time. We are pleased to announce that this year’s Annual Meeting will be a “virtual meeting.” Each stockholder will be able to participate in the Annual Meeting – including casting votes and submitting questions – by accessing a live webcast at Sealed Air’s new corporate headquarters, 2415 Cascade Pointe Boulevard, Charlotte, North Carolina 28208. Your Boardwww.virtualshareholdermeeting.com/SEE2018 and entering the16-digit control number included on the stockholder’s Notice of Directors and senior management look forward to seeing you at the meeting.Internet Availability of Proxy Materials or proxy card.

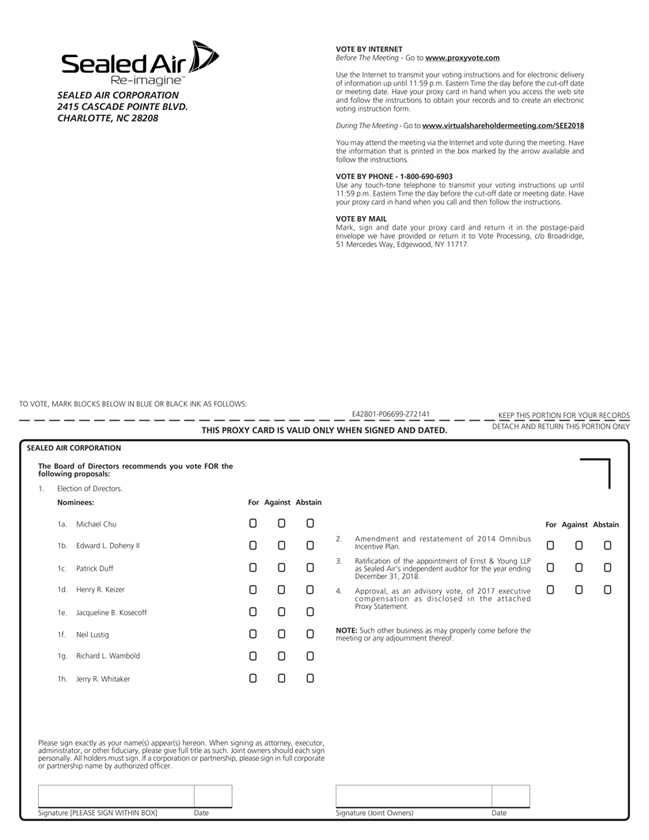

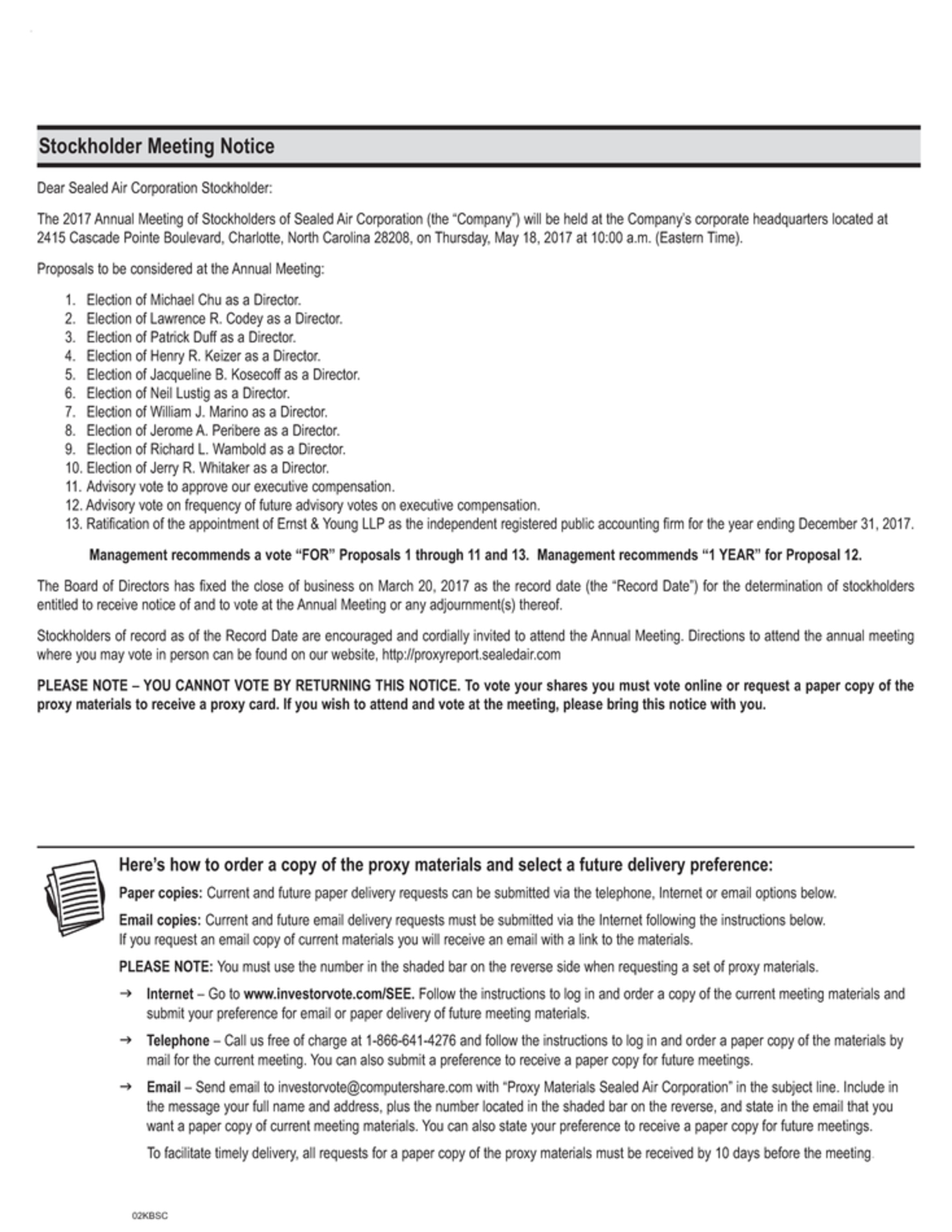

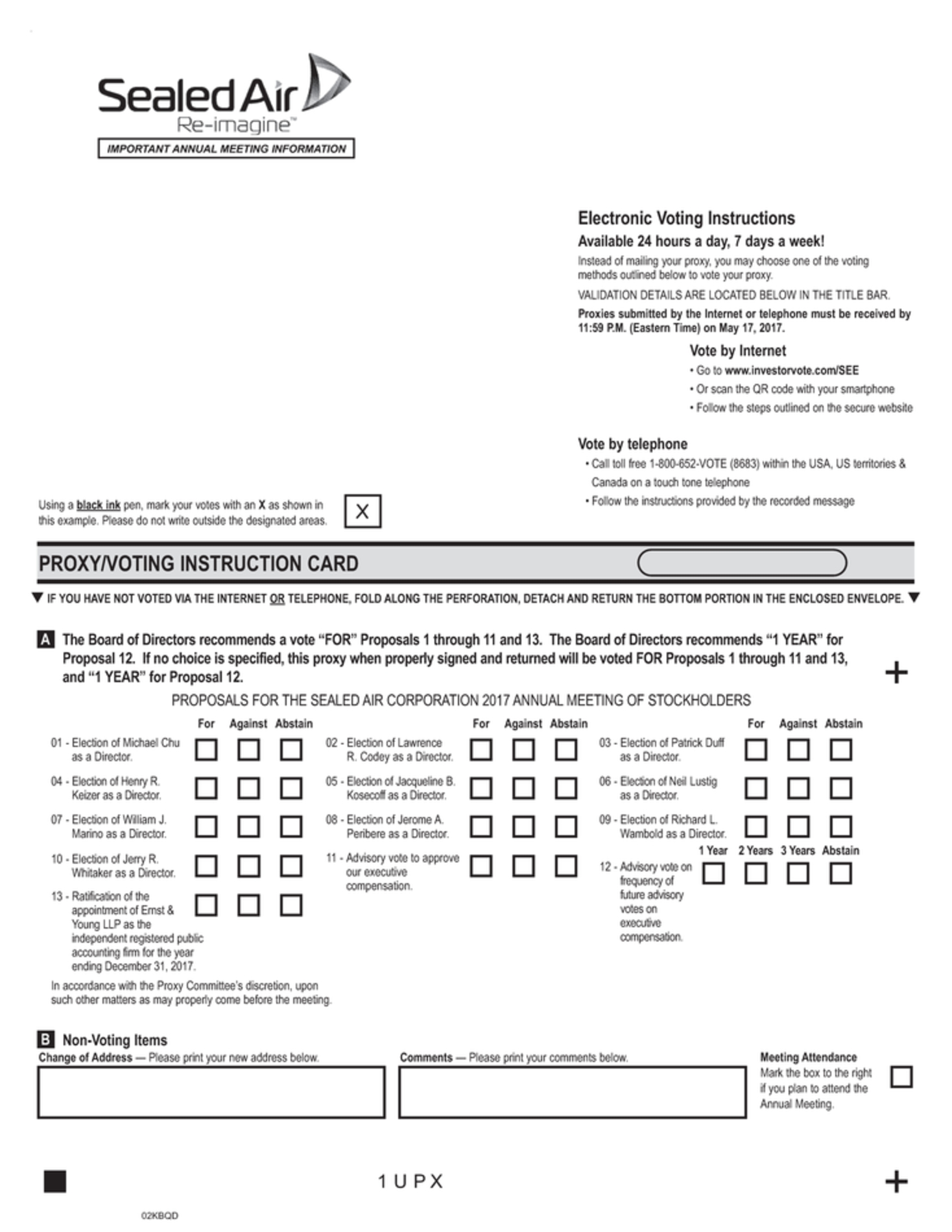

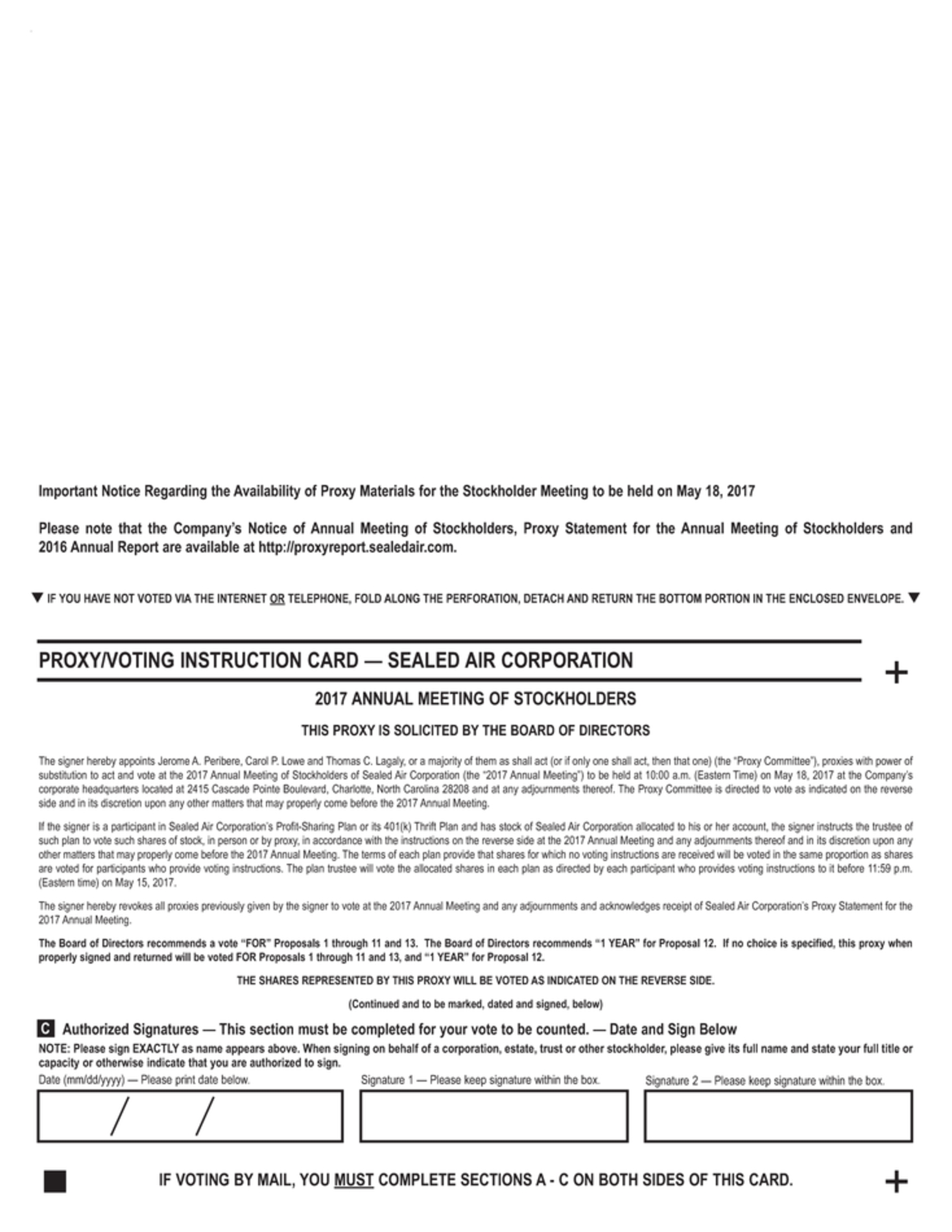

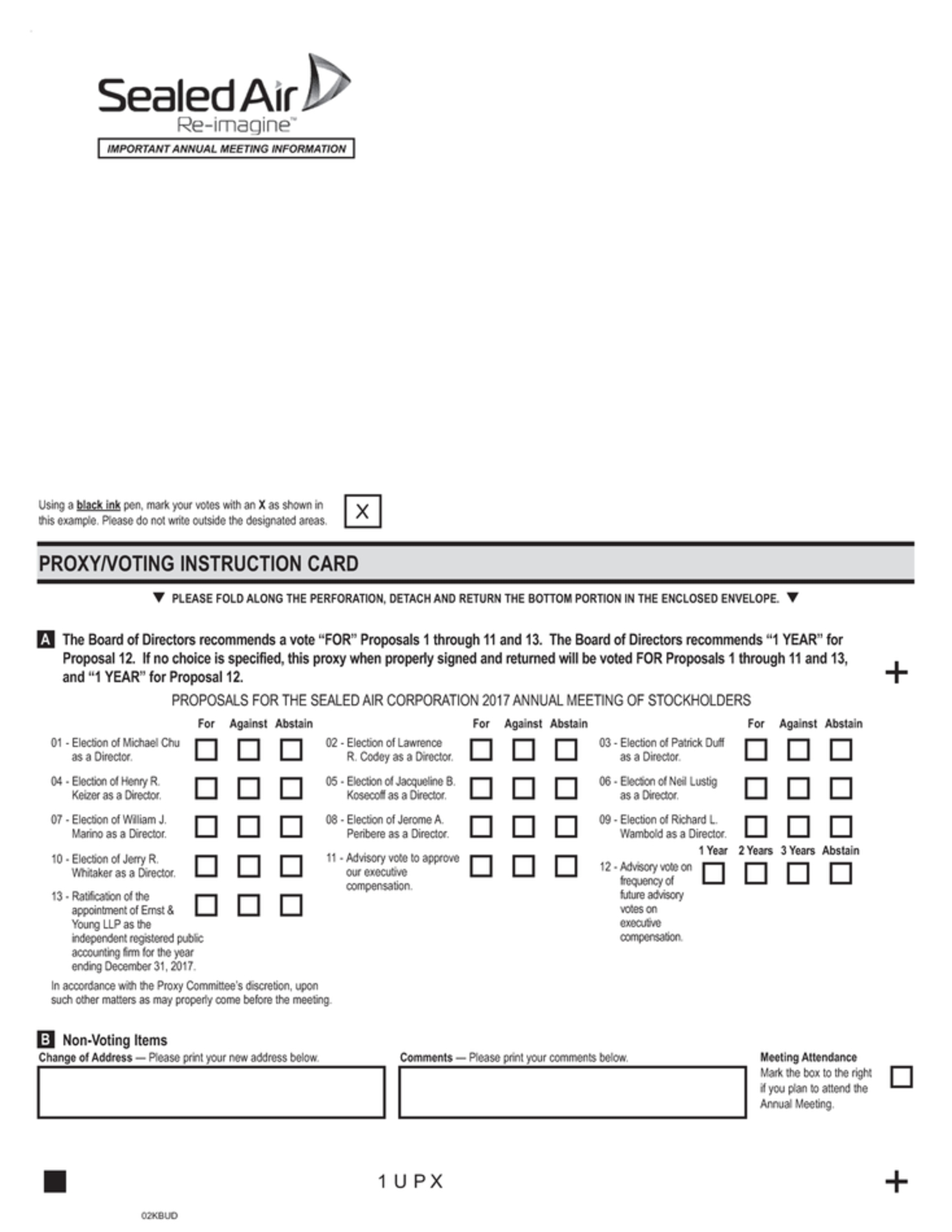

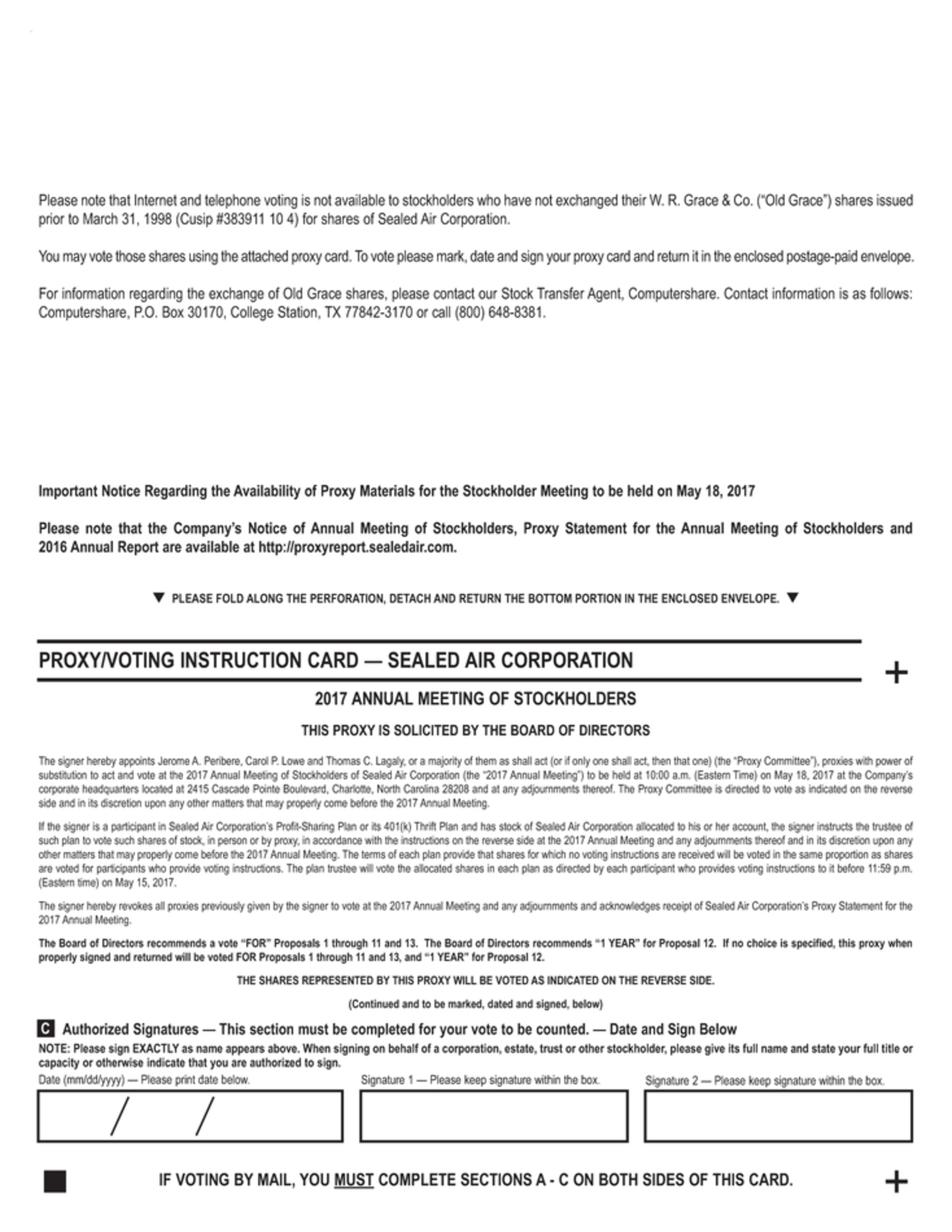

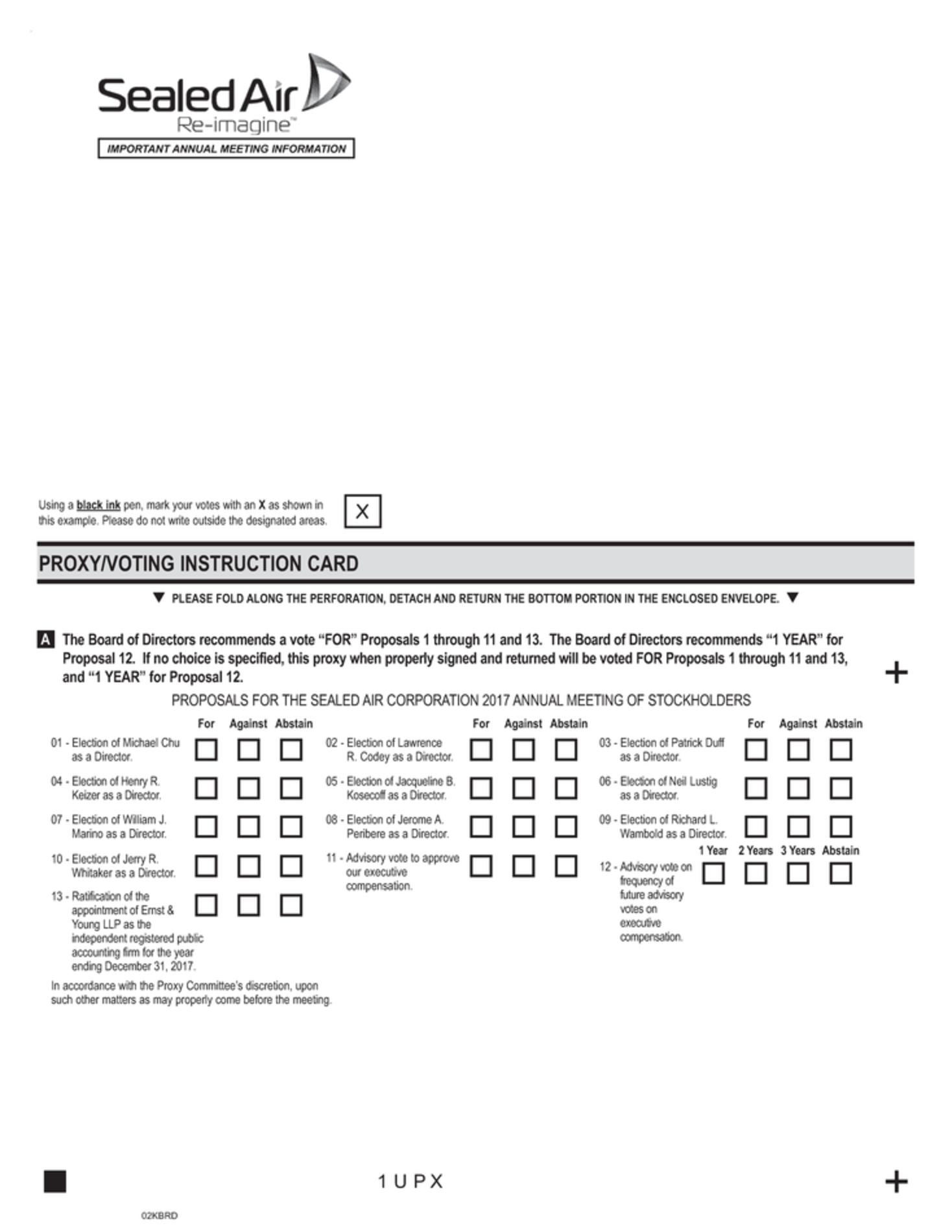

During the meeting, youAnnual Meeting, stockholders will be asked to elect the entire Board of Directors, to amend and restate our 2014 Omnibus Incentive Plan, and to ratify the selectionappointment of Ernst & Young LLP as our independent registered public accounting firmauditor for 2017. In addition, you2018. We also will be askedasking stockholders for an approval, by an advisory votes to approvevote, of our 20162017 executive compensation as disclosed in the proxy statementProxy Statement for the meeting and to establish the frequency of future advisory votes on executive compensation.Annual Meeting. These matters are important, and we urge you to vote in favor of the election of each of the director nominees, the amendment and restatement of the 2014 Omnibus Incentive Plan, the ratification of the appointment of our independent auditor, and the approval of our 20162017 executive compensation and holding future advisory votes on executive compensation on an annual basis.compensation.

For your convenience, we are also offering a webcast of the meeting. If you choose to follow the meeting via webcast, go to sealedair.com/investors shortly before the meeting time and follow the instructions to join the event. We will also post a replay of the meeting for your convenience.

This year, we are again furnishing proxy materials to our stockholders over the Internet. Thise-proxy process expedites stockholders’ receipt of proxy materials, lowers our costs and reduces the environmental impact of ourthe Annual Meeting. Today we sent to most of our stockholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our Proxy Statement for the Annual Meeting and our 2017 proxy statement and 2016 annual report andAnnual Report to Stockholders, as well as how to vote via the Internet. Other stockholders will receive a copycopies of the Proxy Statement, a proxy statementcard and annual reportthe 2017 Annual Report by mail ore-mail.

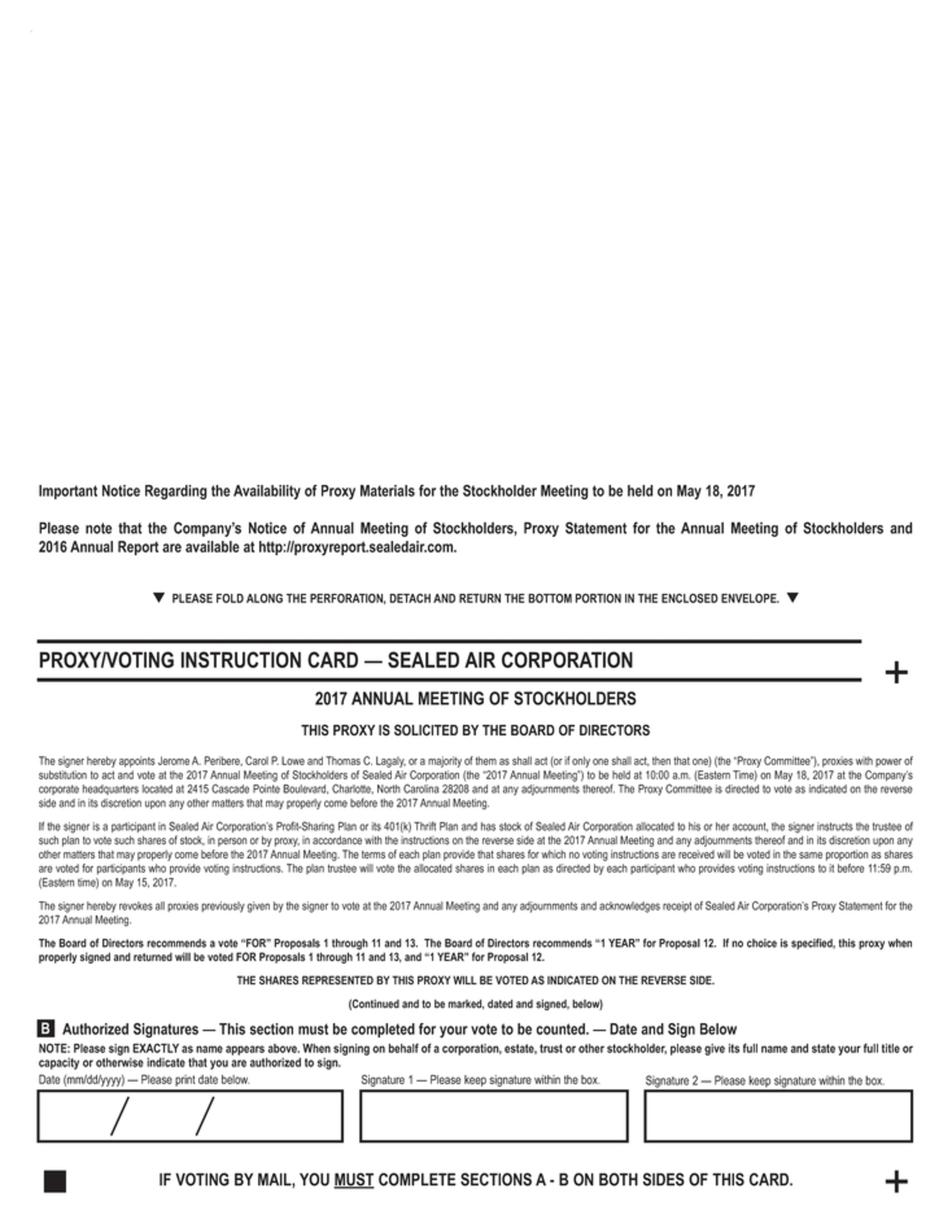

Regardless of the number of shares of common stock you own, itIt is important that you vote your shares of common stock in person or by proxy.proxy, regardless of the number of shares you own. You will find the instructions for voting on theyour Notice of Internet Availability of Proxy Materials or proxy card. We appreciate your prompt cooperation.attention.

We thankThe Board of Directors invites you to participate in the Annual Meeting so that management can discuss business trends with you, listen to your suggestions and answer your questions. Thank you for your ongoing support.continuing support, and we look forward to joining you at Sealed Air’s first webcast stockholder meeting.

Sincerely,

Jerome A. Peribere

Edward L. Doheny II

President and